reit dividend tax rate 2021

FACTS Taxpayer is a State corporation whose. Discover Helpful Information and Resources on Taxes From AARP.

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

For single filers if your 2021 taxable income was 40400 or.

. Your dividends would then be taxed at 15 while the rest of your income would follow the federal income tax rates. MAC s adjusted FFO AFFO of 321 per share in 2017 declined every year thereafter to 157 in 2021. And the shareholders are subjected to tax on the dividends irrespective of the rate of tax paid by the company.

This portion of qualified dividends gets taxed at lower capital gains rates. The tax rate on nonqualified dividends is the same as your regular. These ordinary dividends are taxed alongside your remaining income at the tax rate for which your overall income qualifies.

Fundrise just delivered its 21st consecutive positive quarter. For 2021 these rates remain unchanged from 2020. Ad Bold Trades on Real Estate - In Either Direction Bull or Bear.

40 billion Dividend yield. A Look at MAC Stocks Valuation. Your 2021 Tax Bracket to See Whats Been Adjusted.

710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest. A real estate investment trust or REIT is essentially a mutual fund for real estate. 915 tax rate if shareholder owns more than 50 of the REITs voting stock.

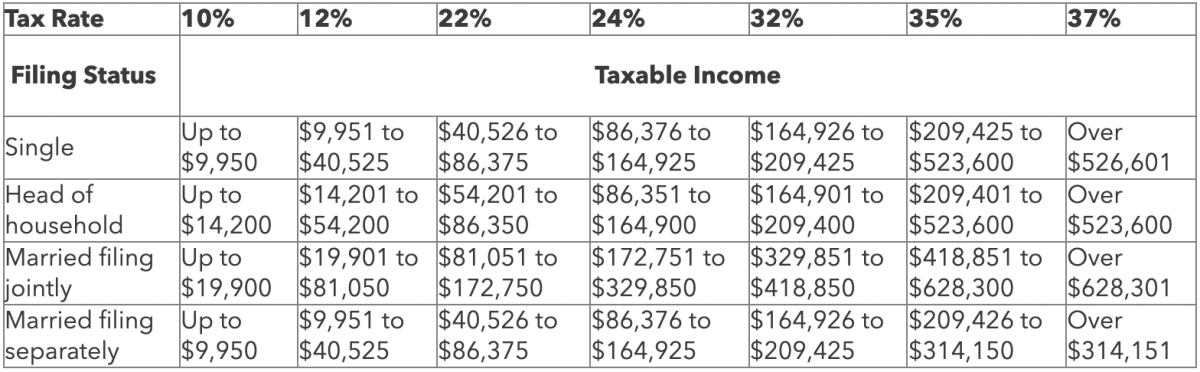

Theres no single tax rate that is. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status.

Federal income tax brackets. The Board also declared a 046875 per share cash dividend to holders of record as of April 15 2022 of the Companys Series A Preferred Stock which was paid on May 2 2022. The tax rate on nonqualified dividends is the same as your regular income tax bracket.

The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. A ReitInvIT can therefore. Singapore Dividend Withholding Tax.

2021 Qualified REIT Dividends. Beginning in 2018 until the end of 2025 if you are a taxpayer other than a corporation you are generally allowed a deduction of up to 20 of your qualified. 5Is there anyway to get a reduced Withholding Tax Rate.

On the plus side we don t expect. Reit dividend tax rate 2021 Thursday March 17 2022 Edit. Article Sources Investopedia requires writers to use primary sources to support.

However the income thresholds for each bracket have been adjusted to account for inflation. However a qualified REIT dividend does not. 4What is the 2021 Withholding Tax Rate for REITs.

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen. Patronage dividends described below do not constitute gross income to Taxpayer for purposes of 856c2 or 856c3. Please refer to the table below.

Geo Overview Real Estate. Click on the filter icon at the top of the Dividend Yield column in the Complete REIT Excel Spreadsheet List. REITs and Capital Gains Taxes.

Download the Complete REIT Excel Spreadsheet List at the link above. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. 830 tax rate if.

VEREIT JAN 2021 Series F Preferred Stock Redemption Form. Ad Compare Your 2022 Tax Bracket vs. 2021 Form 8937 Spin VEREIT AUG 2021 Series F Preferred Stock Redemption Form 8937.

A qualified REIT dividend is generally a dividend from a REIT received during the tax year that is not a capital gain dividend or a qualified dividend. As of January 2 2013 the dividend and capital gains tax rate is 20 for investors making over 400000 and households making over 450000. While RICs can pass through qualified REIT dividends to their shareholders investors may in some.

49 Physicians Realty Trust DOC 1844 invests in medical office properties leased to national and large regional health. 25 May 2021. Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that.

As of July 2021 the company paid a 145 annual dividend and its dividend yield was 354. 199A allows taxpayers to deduct 20 of their qualified REIT dividends. Another exception is dividends earned by anyone whose taxable income falls into the three lowest US.

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Biden Tax Plan And 2020 Year End Planning Opportunities

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

How To Pay No Tax On Your Dividend Income Retire By 40

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

Corporate Tax In The United States Wikiwand

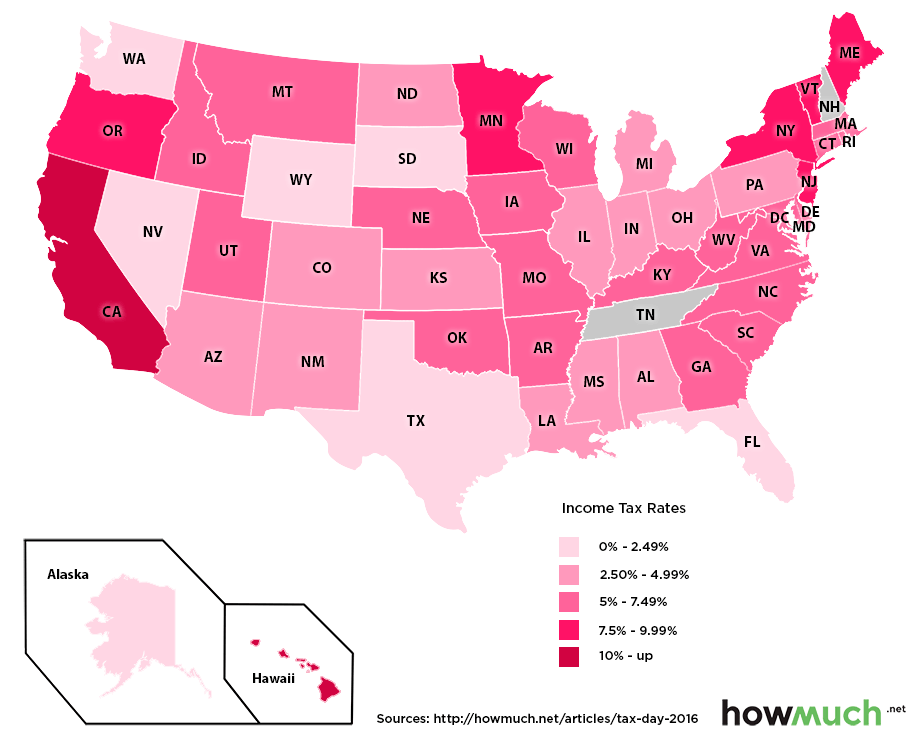

Which U S States Have The Lowest Income Taxes

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Real Estate Or Stocks Which Is A Better Investment

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Sec 199a And Subchapter M Rics Vs Reits

Income Types Not Subject To Social Security Tax Earn More Efficiently